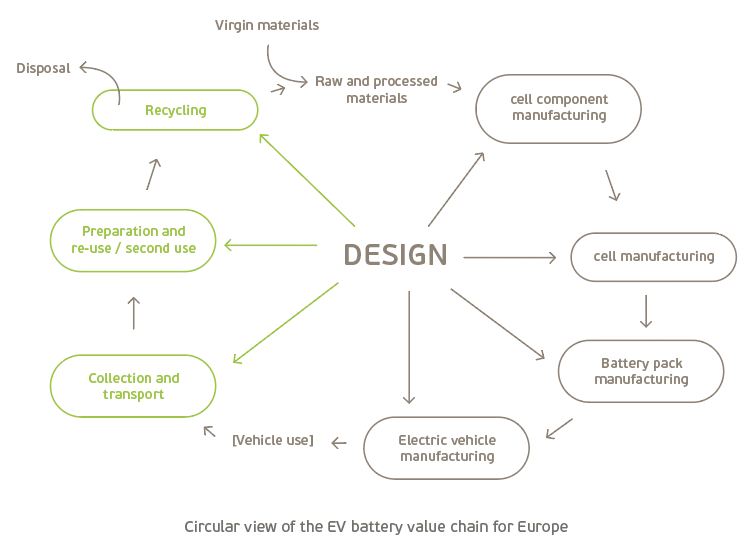

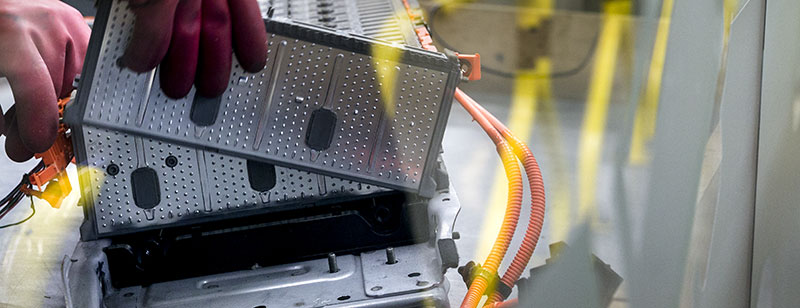

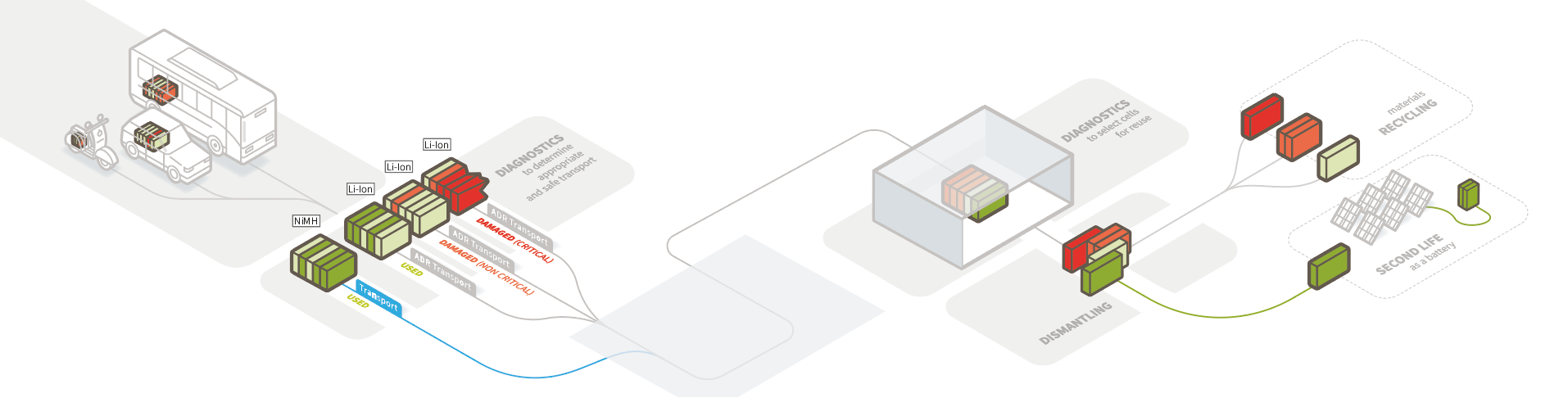

Once the choice has been made on whether the battery will be further processed for reuse, repurposing or recycling, the next step is the dismantling. The dismantling of e-mobility batteries must take place in a controlled environment due to the safety risks involved.

Risk factors of EV batteries:

-

Overheating

-

Fire

-

Gassing (some gases are toxic)

-

Instability (extinguishing is sometimes complicated due to risks of reignition)

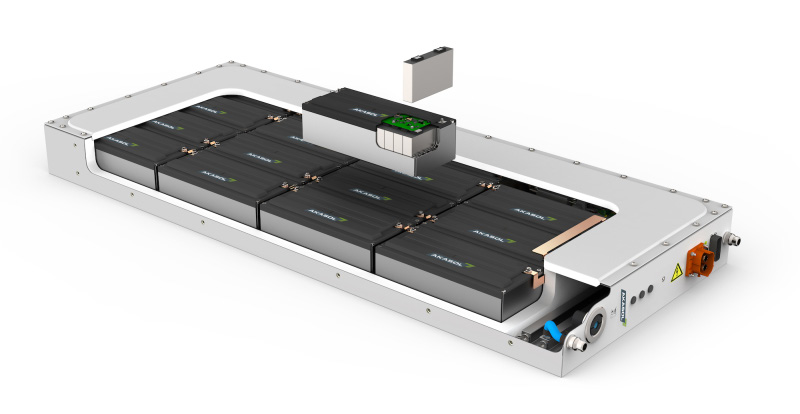

Bebat has high-voltage experts in-house who have been specially trained to dismantling these batteries safely. This means that the battery pack, in which cooling conduits can be integrated, will be removed to free up the battery cells.

The cells will then be incrementally removed, while the voltage is constantly measured.

This means that the battery pack, in which cooling conduits can be integrated, will be removed to free up the battery cells. The cells will then be incrementally removed, while the voltage is constantly measured. This process will also reveal which cells are defective and which are still in perfect working order. Defective cells can then be dismantled for recycling to recover raw materials.

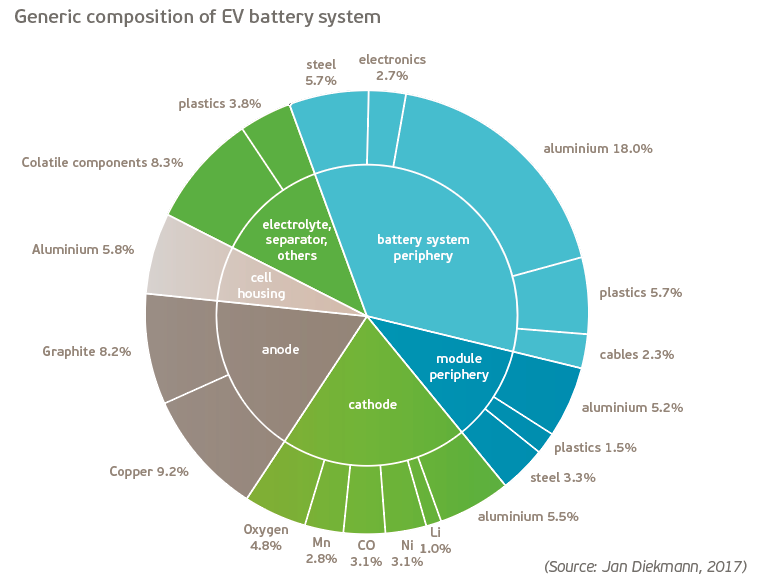

The dismantling is mainly determined by the composition of the battery. Not all e-mobility batteries are the same. There are even significant differences among the same means of transportation.

Examples:

-

The battery of a BMW i3 is made up of 84 lithium-ion prismatic cells

-

The battery of a Nissan Leaf is made up of lithium-polymer batteries

-

The battery of a Tesla is made up of lithium-ion cylindrical batteries.

Dismantling batteries, how is that done exactly?

The diversity of EV batteries arriving at Bebat/Sortbat to be dismantled – more than 10,000 EV batteries sorted in recent years – is enormous. Some are defective or damaged, while others are end-of-life: that is, at the end of their first life.

Geert Allard, Operationeel Manager bij Sortbat

Operational Manager Geert Allard explains more about what happens to EV batteries after they arrive at Sortbat, the Bebat facility where batteries are sorted and EV batteries are examined, dismantled and prepared for recycling, reuse or a second-life application.

An EV battery from a car is the size of a wooden pallet and takes up the floor of the vehicle. The battery is usually screwed down in a solid housing, a protective metal casing that ensures no water, dust or dirt can reach the battery. It is essential that the dismantling procedure always takes place with extreme care. Some brands have specific guidelines that need to be adhered to. Aftercare is always customised work at Sortbat.

Geert Allard, Operationeel Manager bij Sortbat

-

Opening the housing. The protective casing around the battery pack unscrewed and adhesives and silicon resins removed. There are also often electrical components and conduits for coolants and ventilation that need to be removed.

-

Voltage measurements. This takes place prior to and during the dismantling. The modules/cells are gradually removed from the battery pack in order to reduce the voltage for safe processing. Ultimately, all the cells are removed.

-

An EV runs on high voltage. The dismantling procedure therefore requires skilled operators, custom tools, protective gloves and adherence to general safety guidelines.

-

Temperature measurements. Besides voltage, temperature is also measured by means of a heat scan. If this rises above the ambient temperature, it is an indication that something is amiss. Cells that show no deviation from the ambient temperature can be safely stored

-

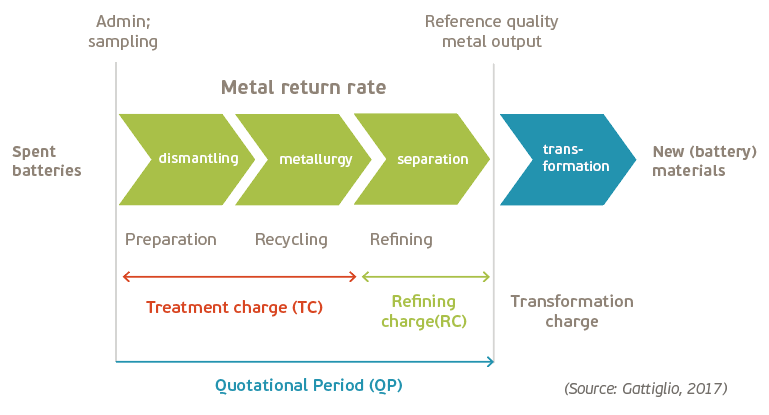

After dismantling. Once the cells have been dismantled, they are taken to a specialised recycling company. The recycler is selected on the basis of the client’s wishes and the specific requirements. Raw materials, especially metals such as cadmium, cobalt, tin and nickel, are usually recovered.

Assessment

Some batteries are eligible for reuse or second-life repurposing applications. Test equipment is used to determine whether these batteries are suitable for this, which involves charging the cells a number of times over 12 to 24 hours. The measured values are then compared with those of a new battery. A decision is then made on the basis of these measurements as to whether the battery should be sent to a partner who can then prepare it for reuse or a second-life application, such as energy storage. The partners collaborating with Sortbat for recycling are recognised recycling processors who meet all the environmental conditions. Sortbat employees are skilled in both mechanical and electrical engineering. After completion of a specific course at authorised trainings centres, they continue their training on the job. Together they ensure that clients can turn to Sortbat for all their battery problems.

Geert Allard, Operational manager at Sortbat.